Basel Accords – Things You Should Know

Basel Committee was developed by BIS (Bank for International Settlements), Switzerland to prescribe the guidelines and general norms to all the International Banks. It is the first organized committee by BIS in 1960’s in order to handle financial imbalances in the banking sector. Basel Committee formulated accords for best practice of banking sector.

History of Basel Committee:

The name Basel was given to the committee on behalf of the place where BIS is located in Switzerland i.e., Basel. Basel Committee came into existence due to the financial imbalances occurred due to the following events –

- Financial Imbalances occurred due to the Arab-Israeli Yom Kippur War which lead to the stoppage of crude oil production.

- The collapse of the Germany’s Bankhaus Herstatt Bank which have a lot of dealings with foreign exchange created a lot financial imbalance.

- Franklin National Bank shut down due to the huge loss in foreign exchange.

To come out of these types of unexpected financial imbalances all the G10 countries and Central Banks established Basel Committee. Basel Committee consists of members from state central banks. It is headed by one of the supervisors or central bankers.

Basel committee formulated all the rules and regulations to be followed by all the central banks. Basel committee set up the rules to withstand banks from unexpected losses and protect the investment kept by customers in the banks under any circumstances. Basel Committee developed Basel Accords (Agreements) in regards of the risks faced by the banks.

Basel Accords:

Basel Accords are the agreements set up by the Basel Committee on Bank Supervision. This provides the regulation in regards of Capital Risk (risk of customer loosing the money invested in the bank/ bank losing the value of it), Market Risk (risk of decrease in the value of investment due to the instability in market factors) and Operational Risk (Risk due to fault of internal procedures, people & systems). BCBS issues 3 Basel Accords – Basel 1, Basel 2, Basel 3.

Basel 1:

Basel 1 also known as 1988 Basel Accord was issued in 1988. It mainly focuses on Capital Adequacy of financial institutions. In 1987, Latin Debt Crises made committee to know that Capital Adequacy Ratios (CAR) of international banks were deteriorating. Taking this into consideration Basel Committee to resolve this type of risk developed Basel 1 in 1988.

Basel 1 was developed based on the risk posed to the stability of the global financial system by low capital levels of active banks (international) and the competitive advantages of banks subject to lower capital requirements. Basel 1 constitutes on 4 pillars:

- Constituents of Capital

- Risk Weighing System

- Target Standard Ratio

- Transitional & Implementation Agreements

Basel Committee categorized the Capital Adequacy risk (risk faced by the financial institution due to the unexpected loss) into five categories: 0%, 10%, 20%, 50%, 100%. This accord called for all international Banks to maintain tier one core capital CAR as less than 4% and tier 2 core capital less than 8%. The committee also refined the framework to address the risks other than credit risk.

Pros of Basel 1:

- It is so simple.

- It lead to the transformations in the structure of the capital requirements in the banks.

- It is unique in including off-balance sheet commitments.

Cons of Basel 1:

- Capital requirements are moderately related to banks risk taking.

- It is static and not adaptable to new banking activities and risk management techniques.

- Its capital rules fails to pick up important differences between risk exposures from bank to bank.

- Its capital rules fail to follow the innovations in banking industry.

- Its unsophisticated measurement of bank’s credit exposure.

Basel 2:

Basel 2 was initially proposed in June 2004 to make an international standard to banking regulators about how much capital banks need to keep aside in order to face the unexpected risks. It includes BCBS recommendations on banking laws and regulations. The objective of this accord is to strengthen, supervise and enhance international banking requirements Basel 2 is about to be implemented completely by 2015.

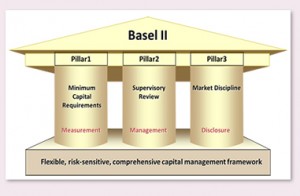

Basel 2 uses the concept of three pillars.

- Minimum Capital Requirements (Develop and expand the standardized rules of Basel 1)

- Supervisory Review (Review on Financial Institution’s Capital Adequacy and Internal Assessment process)

- Market Discipline (Encourage sound banking practices)

The main focus of Basel 2 is on these 3 pillars. Basel 1 deals with only parts of these concepts where as Basel 2 accord is made this as main objective. The major changes imposed by Basel 2 include refining the risk levels of capital adequacy calculations in small banks and to make their minimum capital requirements on inputs from their own internal credit risk models.

Basel 3:

Basel 3 was published in December, 2010 to come out of all the short comings of Basel 1 & Basel 2. The Financial crises occurred in 2007 – 2009 pressured Basel Committee to make a new accord to come out this type of crises. This made BCBS to develop Basel 3 with new capital and liquidity standards. Basel 3 made innovations on

- Common equity

- Capital Buffer

- Leverage Ratio

- Liquidity Requirements

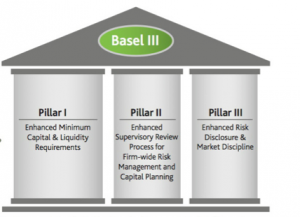

Pillars of Basel 3:

Basel 3 was developed to make a global regulatory standard i.e., to enhance banking sector ability to deal with financial and economical stress, improve risk management and to improve bank’s transparency. Thus Basel 3 is only the continuation of efforts initiated by BCBS under the regulatory of Basel 1 and Basel 2.

Basel 3 established the toughest capital standards and strictly introduced the liquidity requirements. This accord will be phased in by national government banks by 2019. It will raise the capital from 2% to 4.5% further adding a new buffer of 2.5%.

Impact of Basel 3 on Indian Banks:

Basel 3 removes all the loop holes because of Basel 2. Basel 3 norms are based on high capital requirements for the banks. The impact of Basel 3 on Indian Banks are mentioned below –

High Capital Requirement:

Banks need to have high capital in order to follow Basel 3 norms. Banks Common equity ratio will increase with the previous CER of 6- 10 percent. However increase in the minimum capital ratio in government banks will lead to he decrease in capital. The capital requirements will be comparatively less for private banks due to their high profits and high capital ratios.

Pressure on Return Equity:

To meet the norms of Basel 3 without the support of government banks in order to increase the capital need to increase the rate of interests for loans. This results in the decrease of return of equity. To compensate return of equity lending rates should be increased. This results in the decrease of loans indirectly the income of the banks. This will adversely effect the profit of the banks.

Pressure on Assets:

Deployment of funds on liquid assets results in the decrease in the assets and returns of the banks.

Change in Customer Mix:

As per the new norms Retail Banking have less risk compared to corporate banking. In order to earn profits banks need to shift to short term/ retail loans.

Improvement in Systems and Procedures:

In order to handle the higher capital requirements banks need to modernize and improve the practices using in the banks.

Low Cost Funding:

Low- cost deposit is the main factor to be followed by the banks. To follow this banks need to focus on how to reach customers efficiently instead of thinking of new branches.

In case of any query please leave a comment below.

nice to have attain this knowledge

Hello Mr MarketI would like to ask for your advice.From HSBC’s info:20 Aug 08 Shares quetod ex-dividend in London, Hong Kong and Bermuda22 Aug 08 Record date22 Aug 08 Closure of Hong Kong Overseas Branch Register of shareholders for one day25 Aug 08 Shares quetod ex-dividend in Paris08 Oct 08 Payment dateI would like to know when I should hold the HSBC stock to in order to get the dividend. Is that 20 Aug or 22 Aug? Please advice. Thanks a lotTurbo Cat