Latest Base Rates for banks in India

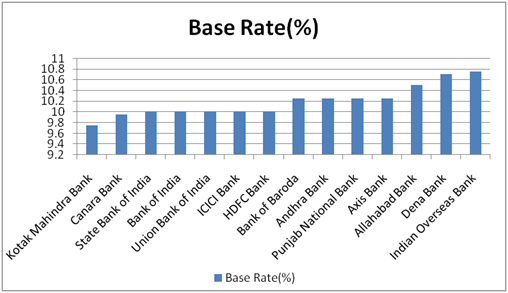

Base Rate Comparison of Banks in India

All public and private sector banks are using the new base rate regime. The base rate is the minimum rate that a bank will lend money to anyone. Think of it as a floor below which RBI will not allow banks to lend to you. The latest increase in the interest rates by RBI has forced major private banks like ICICI, Axis Bank, HDFC and also PSBs like SBI, PNB, CBI, BoB etc to increase their base rates.

Here is the list and comparison of the latest base rates for most public and private sector banks –

Previously, banks used to price the loans they offered to you on a complicated system called benchmark prime lending rate (BPLR). Each bank has its own BPLR methodology which made it difficult for borrowers to compare rates across banks.

Now, with the base rate in place, it will be easier for all of us to compare across banks and to get a more transparent view on how the interest rate for the loan is being arrived at. Here is the base rates for major banks in india. (Last Updated: July 01, 2014)

| Bank | Latest Base Rate(%) |

| Allahabad Bank | 10.5 |

| Andhra Bank | 10.25 |

| Axis Bank | 10.25 |

| Bank of Baroda | 10.25 |

| Bank of India | 10 |

| Bank of Maharashtra | 10.25 |

| Canara Bank | 9.95 |

| Central Bank of India | 10 |

| City Union Bank | 11 |

| Corporation Bank | 10.25 |

| DBS India | 9 |

| Dena Bank | 10.7 |

| HDFC Bank | 10 |

| ICICI Bank | 10 |

| IDBI Bank | 10.25 |

| Indian Overseas Bank | 10.75 |

| IndusInd Bank | 10.75 |

| ING Vysya Bank | 10.2 |

| Karnataka Bank | 10.75 |

| Kotak Mahindra Bank | 9.75 |

| Punjab and Sind Bank | 10.75 |

| Punjab National Bank | 10.25 |

| South Indian Bank Limited | 9.6 |

| Standard and Chartered Bank | 9.75 |

| Standard and Chartered Bank | 9.75 |

| State Bank of Hyderabad | 10.25 |

| State Bank of India | 10 |

| State Bank of Mysore | 10.15 |

| State Bank of Travancore | 10.5 |

| Syndicate Bank | 10.25 |

| Tamilnad Mercantile Bank Limited | 10 |

| The Catholic Syrian Bank | 10 |

| The Jammu and Kashmir Bank Limited | 10 |

| The Karur Vysya Bank Limited | 10 |

| Union Bank of India | 10 |

| United Bank of India | 10.45 |

| Vijaya Bank | 10.45 |

| Yes Bank | 10.5 |

it nice web site, but you have to provide all banks base rate

Very good site, please provide base rate of all the associate banks of SBI with effective date/

good one

very good site pls include Tmb & Lakshmi villas bank & indian bank

Needful Updates

Very good information under one webpage.

We would be happy if you will include all Banks.

So in that case it will be much easy to track Base Rates…..

Please post Base Rate ( Lending) of all PSUs, Private Sector Banks and foreign Banks which will be useful to those who visit your site.

Thank you’

Muralidhar

Good information. Thank you! Can you please specify if a bank can have different base rate for existing vs new Loan customers? OR is it “one bank, one base rate” rule?

Very informative. Is there any official website of RBI where I can see current base rate and historical data as well?

i like but minimum banks cover .

Productive Information

all banks are not covered in this MIS. Kindly add UCO bank, Kotak mahindra bank and some other bank.

Hi,

Kinldy include LIC in this list for better clarity.

Rgds,

Vijay

Hi,

Kindly include LIC in this list for better clarity.

Rgds,

Vijay

Lic is not a bank

plz display all indian banks interest rates

what is mean by assests and liabilities

REALLY A GOOD SITE FOR ECO-MAN

REALLY A GOOD SITE FOR SMALL ENTERPRISE.

good site easy to access

this site needs to be updated.

The information is one year old. Please post the current information.

the information is old.please post the current information

P/z upload latest base rate of all bank w.e.f 30/06/2014

updated!

simple description

Union Bank of India has increased its Base Rate by 0.25%, or 25 basis points from 10.00 percent to 10.25 percent with effect from Friday, September 06, 2013.

Please update the same accordingly.